06 Feb The Good Work Plan – Citation Guest Blog

What does the Good Work Plan mean for the cleaning industry?

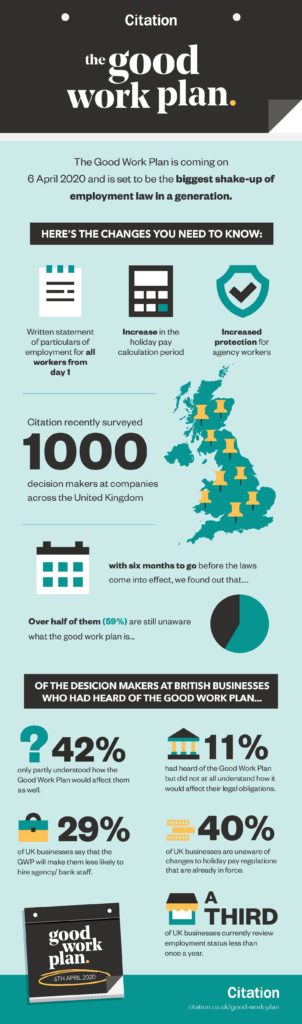

When it was published in December 2018, the programme of employment law reforms outlined in the Good Work Plan was described as “the largest upgrade to workplace rights in a generation”.

Still, it has remained relatively low profile, with 60% of business owners surveyed by Citation having little or no knowledge of the changes ahead.

April 2019 saw the first phase of implementation take place with the introduction of new requirements regarding pay slips and an increase in the maximum penalty Employment Tribunals can award for ‘aggravated breaches’ of employment rights from £5000 to £20,000.

The next phase comes into force on 6 April next year and will introduce the following changes for all businesses:

- They will have to give statutory written details of terms to employees and workers (currently they only need to do this for employees)

- This information will have to be given by day one of their engagement (currently employers have two months to do this)

- The information which needs to be included in these statements has been extended

April 2020 will also see new rules coming into force regarding agency workers and the calculation of variable holiday pay.

The government has recently concluded various consultations on how to carry out the following phase of reforms including:

- Establishing a new agency responsible for all labour market enforcement and extending this to cover state enforcement of holidays for ‘vulnerable workers’ – i.e. those working under more flexible arrangements.

- Measures to tackle unfair flexible working practices. This includes the right to reasonable notice of working hours and compensation for the cancellation of shifts with less than reasonable notice.

All these reforms are designed to tackle the challenges faced by the changes in the way many people work in the UK. There’s been a huge growth in the use of casual working and self-employed arrangements, and this is very evident in the cleaning sector.

The reforms are designed to retain this flexibility, which is seen as vital to economic growth, but give much greater clarity on the terms of engagement, making it easier for individuals to understand and enforce their rights.

At the heart of this is the issue of correctly identifying the employment status of those who work for your business, as employment rights are governed by this.

The government concedes that this is an area of unacceptable uncertainty and has promised legislation to clarify this, but there’s no sign of this on the horizon just yet. In the meantime, many businesses rely upon common misconceptions in this area.

A lot of business owners and employers believe that employment status is what is agreed with the individual, what is written in their contract or how they are treated for tax purposes. In fact, it is based upon a detailed evaluation of how the relationship works in practice.

Many employers in the cleaning sector may find that individuals who start working on a casual or self-employed basis have evolved into employees through their pattern of engagement.

Got any questions or want to book a free consultation?

With over 20 years’ experience helping businesses in the cleaning industry, Citation is proud of our longstanding Corporate Partnership with BICSc.

BICSc members can claim an exclusive, free of charge support session with Citation, plus can get preferential rates on their support packages. This includes their HR, Employment Law and Health & Safety service including a 24/7 expert advice line, 100s of model documents, contracts and templates, and a dedicated local consultant with annual site visits. Plus, they can support you with training, fire and electrical safety services, ISO Certifications, and SMAS Accreditation.

To book a free consultation or find out more, click here, or call 0345 844 1111 to speak to a friendly advisor for any questions you have.